Meet the Founder: Jonathan Binder

With emerging markets in his blood, Consilium co-founder and Chief Investment Officer Jonathan Binder loves being a one-eyed king in the land of the blind.

With emerging markets in his blood, Consilium co-founder and Chief Investment Officer Jonathan Binder loves being a one-eyed king in the land of the blind.

His international upbringing fueled his drive to understand the history, economics and politics of emerging countries that are outside the purview of most investors. We sat down with Jonathan to learn more about his unique background and what led him to found Consilium.

Can you tell us about your childhood and what you learned from your parents?

Those were fascinating trips, and I took for granted how much I was able to do and see at such a young age. My mother’s side of the family had deep ties to the Indian Civil Service, so a strong interest in foreign cultures is in my blood, so to speak, and what I do now seems to me a natural extension of my childhood.

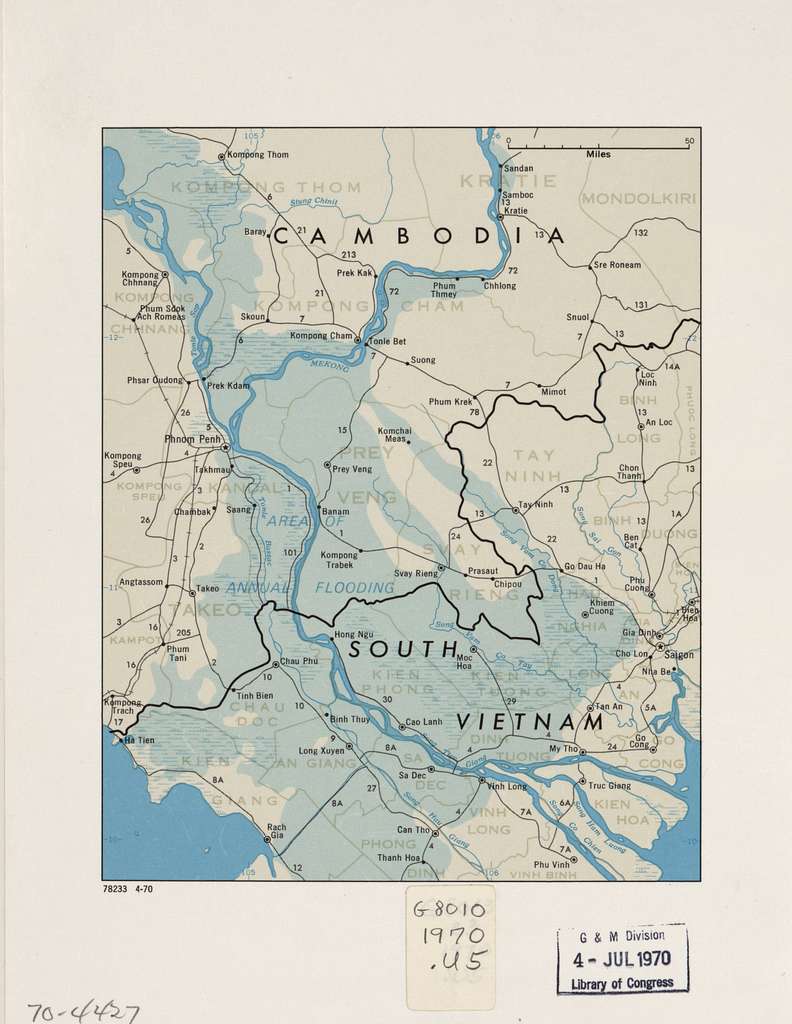

What was it like spending time in Cambodia as a kid in the early 70’s?

What was it like spending time in Cambodia as a kid in the early 70’s?

It wasn’t rare to see a stray rocket or for the windows on our house to rattle as the U.S. was bombing nearby Vietnam, but overall it was a pretty typical expat experience. There was a French sports club where I played tennis, and on the weekends everybody relaxed on their respective houseboats on the Mekong. I like to tell people that’s where I learned how to water ski.

How did you find your way into the EM space?

I started my career drafting prospectuses at an investment bank in London before I joined James Capel, a firm known for its international equities business, on their fixed income sales & trading desk. In 1988 I was given the opportunity to run a small sales & trading desk for them in New York. The firm later noticed their U.S. clients were eager to invest in Mexico, and they decided to take a chance on me to build out a business there. I wheeled in an economist friend of mine and a few analysts, and in time we expanded to cover most of Latin America. Around that time the Berlin Wall came down and Russia and Eastern Europe became this wild resource grab, and we started getting involved there, as well as Africa. We basically became a frontier broker-dealer with research and trading, and we even did small capital raises for some companies. As a Frontier and EM investor I often think of myself as the one-eyed king in the land of the blind. I love that very few other people do what I do.

What led you to break away and start Consilium?

The long-short of it was that I had spent most of my career successfully building businesses within bigger businesses and I reached a point where I was no longer interested in the politicking that goes on at large companies. In 1997 I moved over to the buy-side and started managing an EM portfolio at Americas Trust Bank, which is where I met Charlie. After a crisis in Ecuador crippled parts of Americas Trust, we lifted our business over to the Standard Bank of South Africa. Over six years we were able to grow our portfolio to about $2.3 billion from only a few hundred million, and most of those assets were from a sub-advisory relationship we had with American Express Bank. Around 2003, the guy who oversaw our team at Standard Bank left to start his own business, and things became increasingly difficult for us there. Charlie and I finally agreed we should break away and start our own firm. We were young and foolish enough to assume that American Express would come with us, but it turned out they didn’t want to take on the startup risk with Consilium, and so it was a bit of a tragic start for us. Fortunately, we were able to win back their business two years later.

Who do you look up to in the investment industry?

One of the guys I admire most in our business is Stanley Druckenmiller. His guiding principle is that investors must be open-minded and flexible, but also committed. I think that encompasses what investment management is all about. Sometimes you need to have the ability to change your mind and know that you got something wrong. At the same time, if you’ve done all the work and you’re confident about your idea, you can’t let yourself be swayed by others’ opinions or short-term fluctuations in the market.

What investing lessons have you learned in your career?

In the past I’ve been too generous and optimistic about countries recognizing the error of their ways and moving towards better economic policies. Hope is not an investment strategy. At the beginning of last year I had a shining light moment and decided we can no longer afford to be invested in countries that are dysfunctional, and over the course of the year we cut our exposure to places like Egypt, Kenya and Argentina, which are simply not meeting the basic needs of their people.

What do you like to read?

Niall Ferguson is someone I love to follow and read. A couple of my favorites from him are Civilization: The West and the Rest, and The Great Degeneration.

What do you get up to in your free time?

I have a weekly doubles tennis game and my partner and I have been playing together since the late nineties. He’s 81 and probably the best player on the court. I also do some yoga – not as much as I’d like these days – but that’s been a great thing for me.

Are you involved in any non-profits or charities?

I focus mostly on military charities that care for the families of those who have been killed or injured in the line of duty. I’ve been lucky enough not to have been personally touched by that type of tragedy, but over the years I’ve become very aware that many families are not getting as much help as they need.

Do you have a favorite Wall Street movie?

Definitely the original Wall Street. That movie came out in ’87, the year before I moved to New York, so that was a big part of it. Trading Places is a close second. I’m also a huge fan of the movie Gladiator – I basically have to watch it every three or four months.