Meet the Founder: Charlie Cassel

A life on the water has equipped Consilium co-founder and CEO Charlie Cassel with a mindset that’s allowed him to successfully navigate the unpredictable nature of emerging markets investing.

A life on the water has equipped Consilium co-founder and CEO Charlie Cassel with a mindset that’s allowed him to successfully navigate the unpredictable nature of emerging markets investing.

We met with Charlie to discuss his approach to risk management, his investment philosophy, and that time at sea he became a real-life cast away.

Tell us about your family and how they shaped your worldview?

Family narratives are all about oral histories and your perception of how you fit into them. Mine share similarities to most immigrant stories. The perseverance of my grandmother’s Scottish family that came through Canada to settle in Michigan’s Upper Peninsula and endure the harsh winters to have land of their own to farm. And the single-minded determination of my German grandfather to find a better life for he and his family when they arrived in Detroit in about 1910. He put himself and his five brothers and sisters through college after having arrived penniless and living his first few years in the YMCA. I don’t know if it’s nature or nurture, but a lot of the patience and determination needed to co-found and manage an investment management boutique can be traced to those that came before me..

What was it like growing up in South Florida?

South Florida was a different place when I was a kid in the 70’s than it is today. It wasn’t concrete and shopping malls all the way to the edge of the Everglades. People didn’t live behind gates and parents (at least mine) didn’t fear giving their kids the freedom to explore. With a very outdoors oriented lifestyle with the ocean being a focal point, a lot of time was spent on fishing, diving, water skiing…anything to be out on the water. One of the primary ways of getting around was by boat. At 10, I had the use of our family’s skiff and it gave me a lot of independence and responsibility - not just for my dad’s boat, but for the friends that came on it with me. That was something unique and it has always stuck with me. I learned from an early age that I had to own my mistakes. Paddling is no fun if you run out of gas! And that meant learning to prepare for contingencies and always be ready for the unexpected. I think that early experience served me well later in my professional career in understanding how to manage risk.

Are there any memorable experiences you had at sea?

Are there any memorable experiences you had at sea?

There’s always a fishing story and the one that got away! But the story that means the most to me happened when I was about 14. We were in the Bahamas on a family vacation, and my dad and I had been diving for lobster most of the day. Tired and sunburned, we were on the way back to the dock in the late afternoon and we weren’t paying attention like we should have been. We ran aground on a sandbar on an outgoing tide and knew we were going to be stuck for 6-7 hours until well after dark. Thankfully, it was close enough to an uninhabited island that the sandbar came out from that we could wade over to it to collect enough driftwood to make a fire. There’s nothing better than a father-son memory of cooking fresh lobster and the awe of looking at the Milky Way.

How did you find your way into the investment industry, and did you have any influential mentors early in your career?

I went to Washington & Lee in Virginia for my undergrad and there I focused on economics because I was more interested in how the entire system was put together and functioned, rather than in specializing in a more narrowly focused finance-related discipline. When I graduated, my plan had been to move to New York to work on Wall Street, but my father was ill and I decided to move back to South Florida to support him and my mother. I ended up working in the treasury department at BankAtlantic, and about three months into the role I caught the attention of the Chief Investment Officer, Lew Sarrica. He was a contemporary of Lew Ranieri and was one of the early investors in the mortgage-backed securities market. He taught me a lot of the basics, but more importantly he showed me that trading is as much about people and behavior as it is about value. I was lucky early in my career to have had the opportunity to trade a billion-dollar book of MBS and to have had a mentor that was instrumental on starting me on my career path.

Tell us about your transition into the emerging market space?

I transitioned out of BankAtlantic during the savings and loan crisis in 1992, when finance jobs in South Florida were hard to come by. I was recommended by a friend for an interview with a Colombian bank in Miami that needed help restructuring a large book of LDC debt. I was experienced in the financial markets and was able to quickly apply what I knew in emerging markets and never looked back.

When did your path cross with Jonathan’s?

I ended up leaving the Banco Cafetero in 1997 after five years because my role had slowly moved away from portfolio management, and I moved over to Americas Trust Bank where I started managing EM debt portfolios with a really talented group of people. That’s Jonathan and I met. We were doing sub-advisory work for Merrill Lynch and American Express Bank and it was a great spot for us for about three years until a crisis in Ecuador led to massive redemptions on the private banking side of the business. At that point Jonathan and I lifted out the American Express business and brought it over to Standard Bank of South Africa, where we worked together until founding Consilium in 2004.

How has your experience of living through a number of EM crises influenced you?

It doesn't matter where it happens or what the cause, they all have the common thread of a liquidity crisis. When people need to exit, they want cash and it doesn't matter what the fundamentals are. Whether it’s Asia, Argentina, or Russia, from a risk management perspective you always end up going full circle back to the principle of making sure you know the exit route when you’re first making an investment. Ultimately the EM space is prone to crises, and if you don't get your risk management right, you're going to regret it.

Who do you admire most in the investment business?

Sir John Templeton comes first to mind for being a pioneer and making emerging market investing mainstream. I also really respect Ray Dalio for the thoughtful and intricate systems he’s built his business around. Bother were not only great portfolio managers but also impressive entrepreneurs.

Do you have a favorite quote?

“Perfection is not attainable, but if we chase perfection we can catch excellence.” - Vince Lombardi

What do you like to read?

I've always been a huge fan of science fiction and have read most of the classics. Trying to imagine what the future might look like is always a fascinating exercise for me. One that I read recently was The Three-Body Problem by Liu Cixin.

Are you involved in any organizations outside of work?

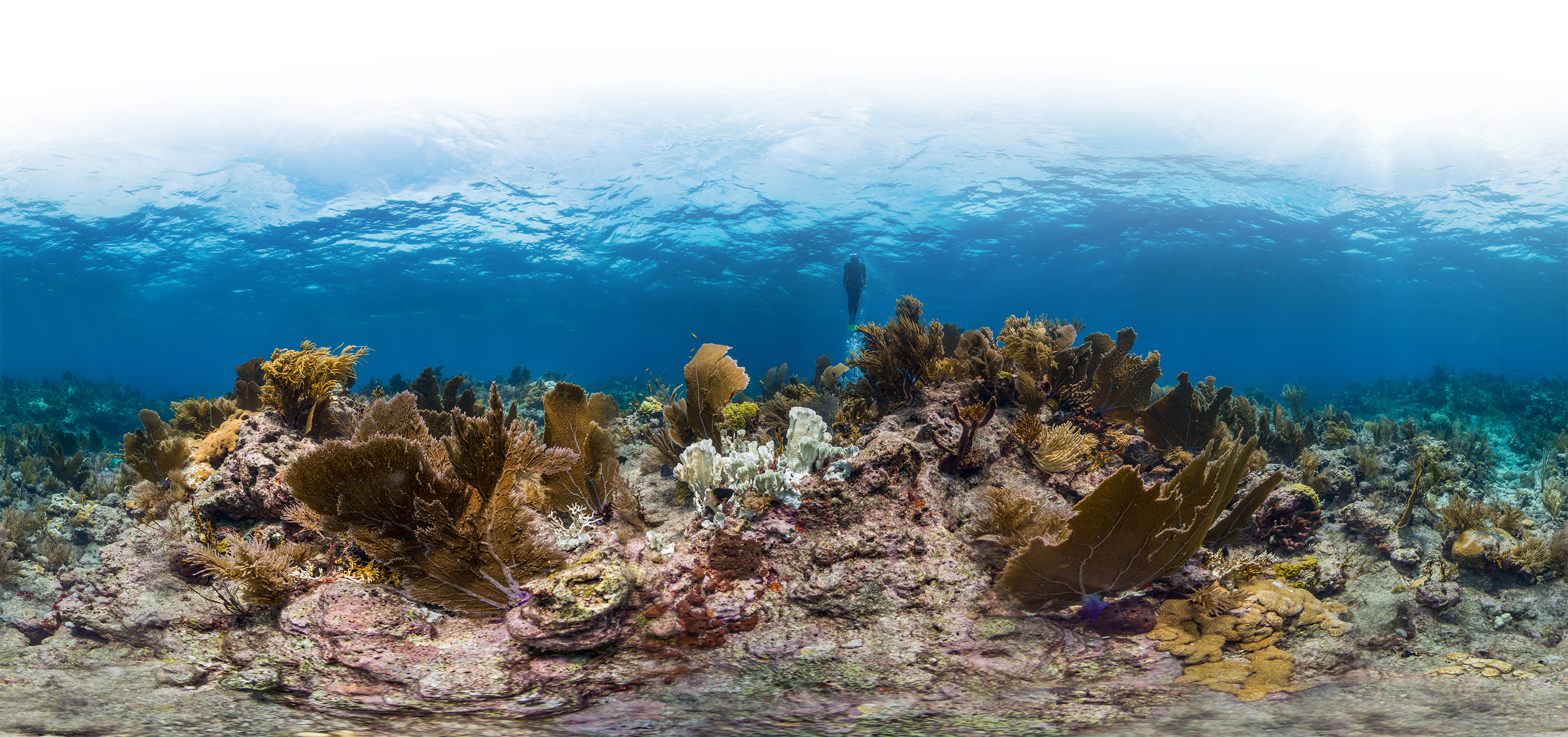

As a lifelong angler I'm big into conservation and am a supporter of the Coral Restoration Foundation in the Florida Keys. Much of the damage to the reefs start in the Everglades and they are affected by diminished water flow and fertilizer runoff that works it way down into Florida Bay and the reefs in the Keys. The Foundation is doing a lot of great work to design systems to regrow corals and to keep our reefs healthy.